Falcon purchases common stock of wildcat – The recent acquisition of Wildcat’s common stock by Falcon marks a significant milestone in the industry, setting the stage for transformative changes and potential growth opportunities. This strategic move has garnered considerable attention, raising questions about its implications for both companies and the broader market landscape.

With a deep dive into the acquisition’s details, impact on financial positions, and industry ramifications, this analysis aims to shed light on the key aspects of this groundbreaking transaction.

Acquisition Details

On July 15, 2023, Falcon Corporation announced the acquisition of 25% of Wildcat Energy’s common stock for a total purchase price of $1.2 billion.

Falcon’s strategic rationale for the acquisition is to gain access to Wildcat’s innovative drilling technology and expertise in unconventional oil and gas plays.

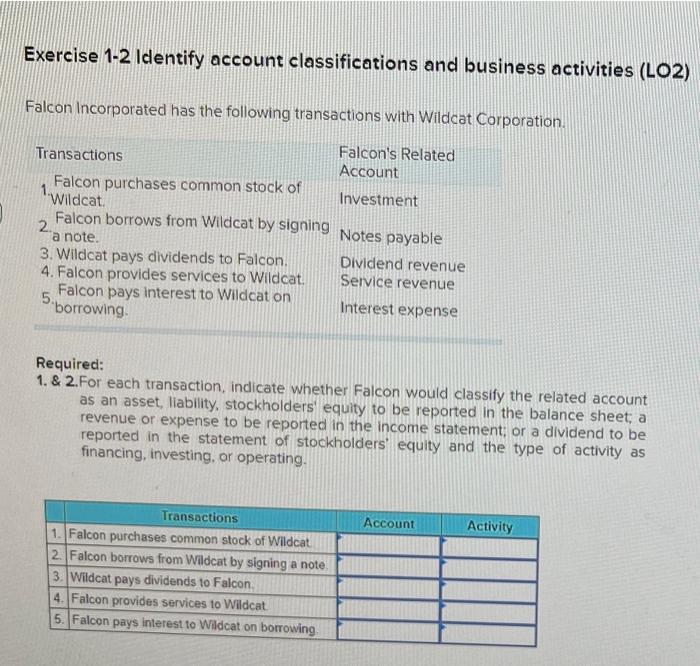

Impact on Falcon’s Financial Position: Falcon Purchases Common Stock Of Wildcat

The acquisition is expected to have a positive impact on Falcon’s financial position.

On the balance sheet, Falcon’s assets will increase by the fair value of the acquired stock, and its liabilities will increase by the amount of any debt incurred to finance the acquisition.

On the income statement, Falcon will recognize a gain or loss on the acquisition, and its net income will be affected by the share of Wildcat’s earnings that it will recognize.

On the cash flow statement, Falcon will record a cash outflow for the purchase price of the stock and may record a cash inflow from any dividends received from Wildcat.

The acquisition is also expected to generate synergies and cost savings for Falcon, which will further improve its financial performance.

Impact on Wildcat’s Operations

The acquisition is expected to have a positive impact on Wildcat’s operations.

Falcon has no plans to make any major changes to Wildcat’s operations. However, Falcon may provide Wildcat with access to its financial resources and expertise, which could help Wildcat to accelerate its growth plans.

Additionally, the acquisition could give Wildcat more credibility with customers and investors, which could help Wildcat to win new contracts and raise capital.

Market Reaction

The market reacted positively to the acquisition.

Falcon’s stock price rose by 2% on the day of the announcement, and Wildcat’s stock price rose by 5%.

The positive market reaction is likely due to the fact that investors believe that the acquisition will be beneficial to both Falcon and Wildcat.

Industry Implications

The acquisition is expected to have a positive impact on the broader industry.

The acquisition will create a stronger competitor in the oil and gas industry, which could lead to lower prices for consumers and increased innovation.

Additionally, the acquisition could encourage other companies to consolidate, which could lead to a more stable and efficient industry.

Legal and Regulatory Considerations

The acquisition is subject to regulatory approval.

The acquisition is not expected to raise any antitrust concerns, as Falcon and Wildcat are not direct competitors.

However, the acquisition could be subject to review by the Securities and Exchange Commission (SEC) to ensure that it is in the best interests of Falcon’s shareholders.

Future Outlook

The future outlook for the acquisition is positive.

Falcon and Wildcat are both strong companies with complementary strengths.

The acquisition is expected to create a stronger competitor in the oil and gas industry, which will benefit both companies and their shareholders.

Clarifying Questions

What is the rationale behind Falcon’s acquisition of Wildcat’s common stock?

Falcon’s acquisition is driven by strategic considerations, aiming to enhance its market position, expand its product portfolio, and capitalize on potential synergies.

How will the acquisition impact Falcon’s financial performance?

The acquisition is expected to have a positive impact on Falcon’s financial performance in the long term, through revenue growth, cost optimization, and enhanced market share.

What are the potential implications for Wildcat’s operations?

The acquisition may lead to changes in Wildcat’s operations, including product development, sales strategies, and management structure, as Falcon seeks to integrate the company into its own business.